Imagine waking up to this...

Offers Over $849,000

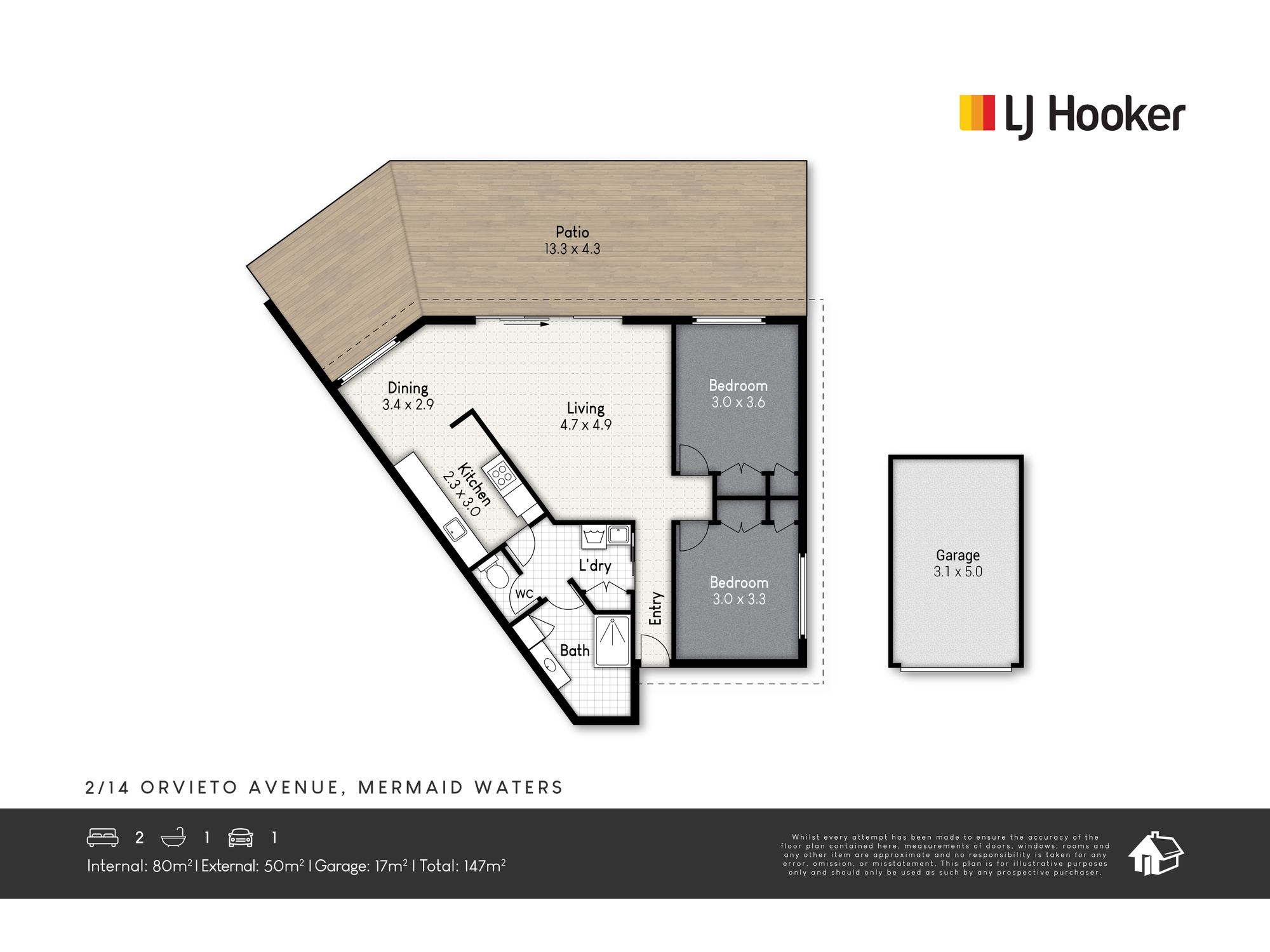

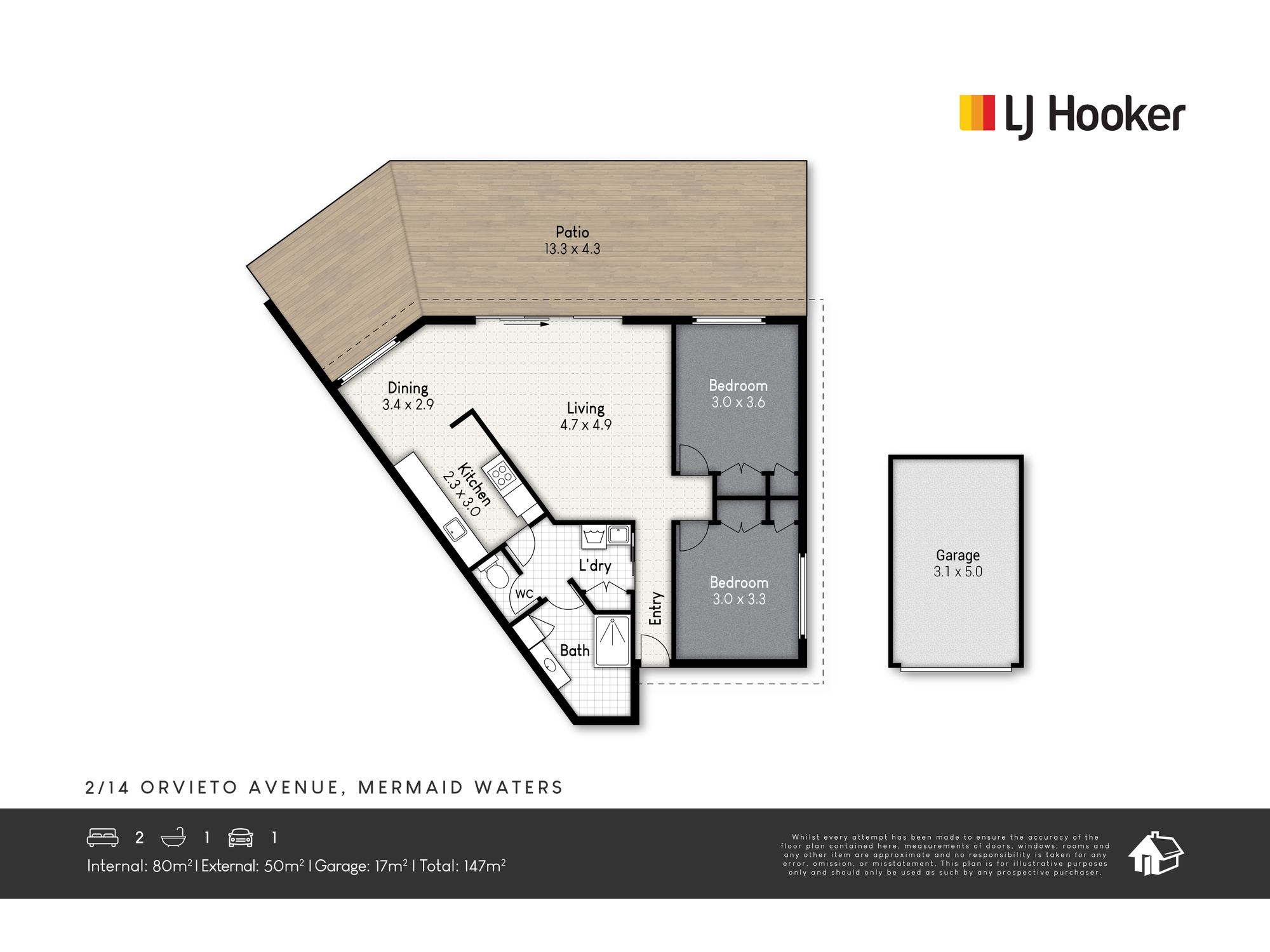

You have found the magic you have been searching for with this stunning 2 bedroom, one bathroom fully renovated unit with 15m of water frontage.

This unit will give you the lifestyle you have always dreamed of.

With cafes only 300m away, surf beaches 900m and Pacific Fair shopping 3km away you will park the car in the SLUG and walk or ride everywhere.

New everything including kitchen, bathroom, flooring , decking with glass panels and air conditioning.

Invite your friends for sunset drinks while the sound of lapping water sets the perfect scene. Don’t let this unique opportunity pass by.

Rental Appraisal $750 – $800 p.w.

Body corp: Approx. $44 p.w.

2

1

1

Jane Doogan

0413 872 972

jdoogan@ljhgc.com.au

Dean McMurtrie

0414 444 779 dean@ljhgc.com.auLooking for something different? Contact me, and I will find the right property for you!